Polymarket is a leading decentralized predictive markets platform that allows users to bet on world events. This report provides a detailed analysis of Polymarket’s key metrics for January 2025 based on LayerHub data.

To get into the top 10% of Polymarket users you need:

- Markets traded: 50+

- Volume traded: $5k+

- Profit/loss: $100+

- Active days: 5+

In this article we will provide key metrics and explain how easy it is to get to the top of Polymarket.

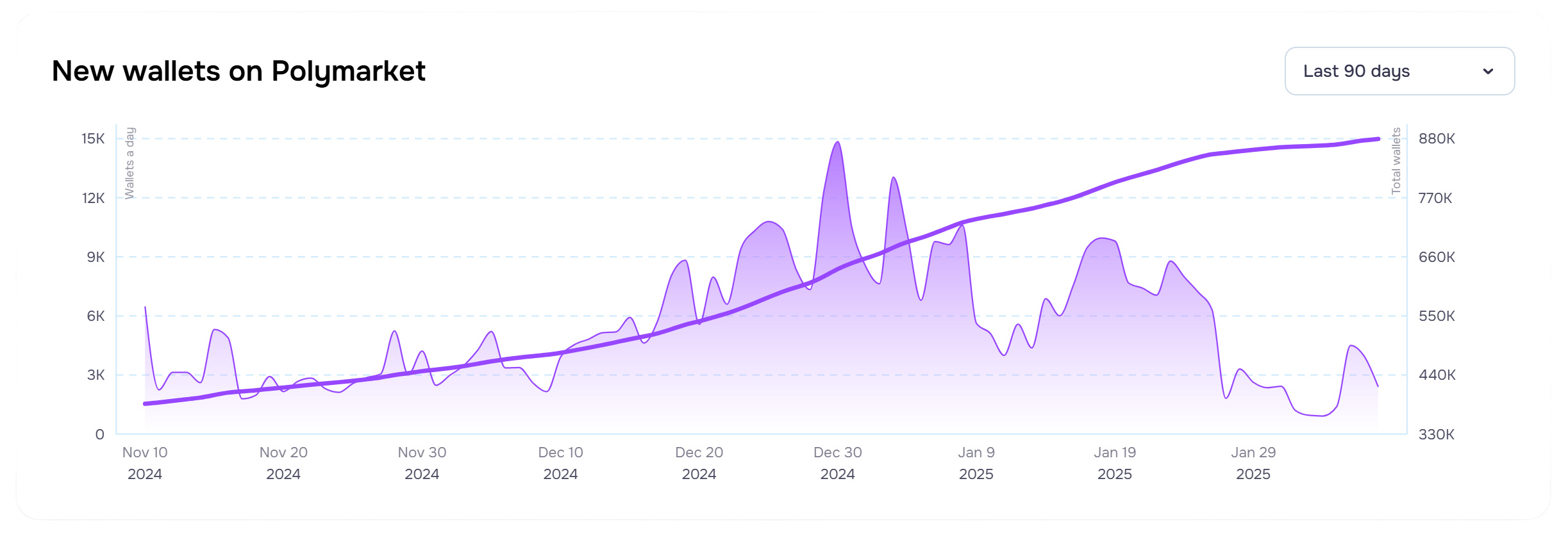

New wallets on Polymarket

On January 31, the total number of wallets was 864,124, which gives an increase of 206,977 wallets in January, i.e. +24%.

On the other hand, Polymarket has exploded from 50k wallets in July to 506k unique users in December – a 900% increase in just 6 months, fueled by the elections and confirmation of an upcoming Polymarket token.

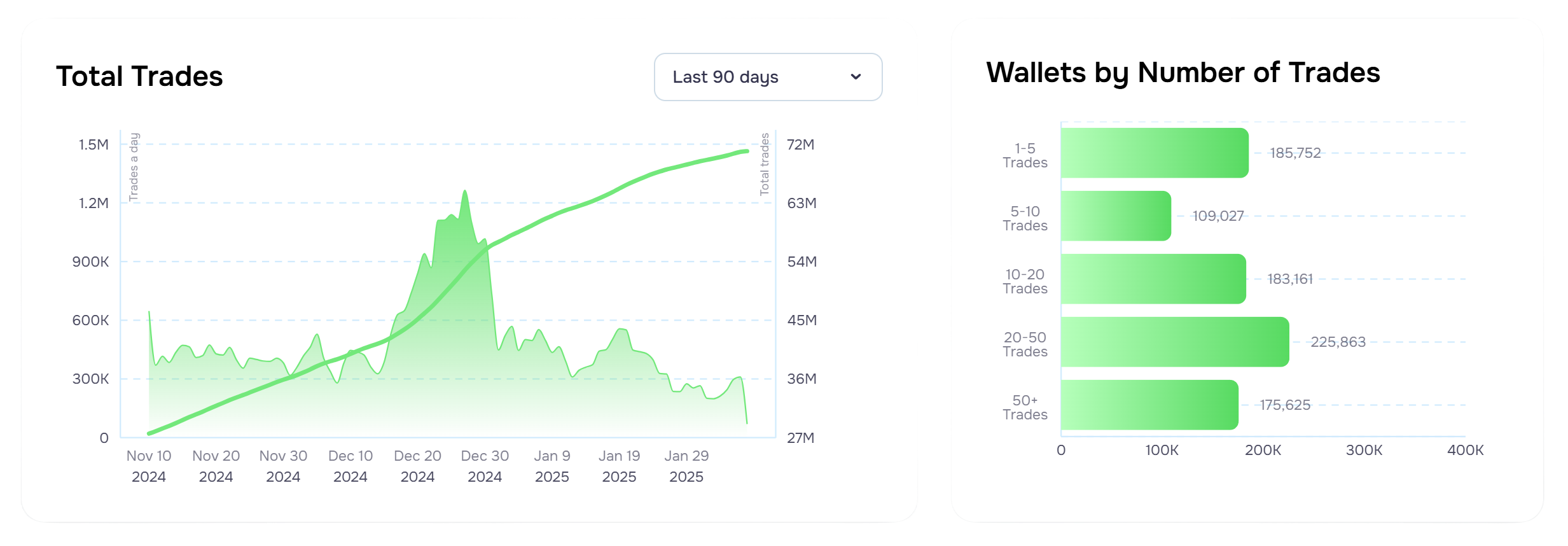

Total trades & wallets by number of trades

On January 31, the number of total trades was 69,395,680, an increase of 12,397,955 in January, or 18%.

But, the overall graph shows a noticeable drop in the average number of trades per day, which in January amounted to about 400k, and in December 650k, as you can see the overall interest is falling and the average net trades for the month decreased by 38%.

But, the chart with the distribution of wallets depending on the number of trades deserves the most attention. You can see that more than half of the wallets (477,940 from 864,124, i.e. 55%) made less than 20 trades, which is very little.

Daily Active Wallets & Wallets by Active Days

Recently, the average value of active wallets does not show a significant change, but still this value peaked in the middle of January with 72,625 wallets, while the average value kept around 40k.

But, again, the chart that describes wallets by active days is more noteworthy. More than 62% (537,804 wallets) were active for less than 5 days.

Wallets by trade volume & total trade volume

If we consider the number of wallets depending on the volume of transactions on them, it is important to note that 82% (703,750 wallets) made less than 5k$ volume. 63% (540,448 wallets) made less than 1k$ volume.

Total transaction volume is falling, on January 31 it was 31,156,014 (down 20M from the peak).

Summary

To summarize, the initial figures of total volume and number of wallets may deflect, but if we dig deeper into the numbers, what we can do thanks to LayerHub’s analytics, it’s important to note that if you have 7+ active days, you’re already in the top 24.34%, over 20 trades puts you in the top 44.94%, and having $1k+ in volume puts you in the top 39.93% – $5k+ volume – you’re in the top 21.42%.

It’s clear Polymarket isn’t overfarmed, and with minimal effort, you can position yourself ahead of most for the airdrop. On top of that, illiquid markets offer insane risk/reward opportunities.

There’s still no official information regarding snapshots or TGE, so if you haven’t participated yet, there’s still time to get involved. To track your personal stats and activity, LayerHub remains a useful tool to stay updated and make informed decisions moving forward. DYOR